Yearly depreciation formula

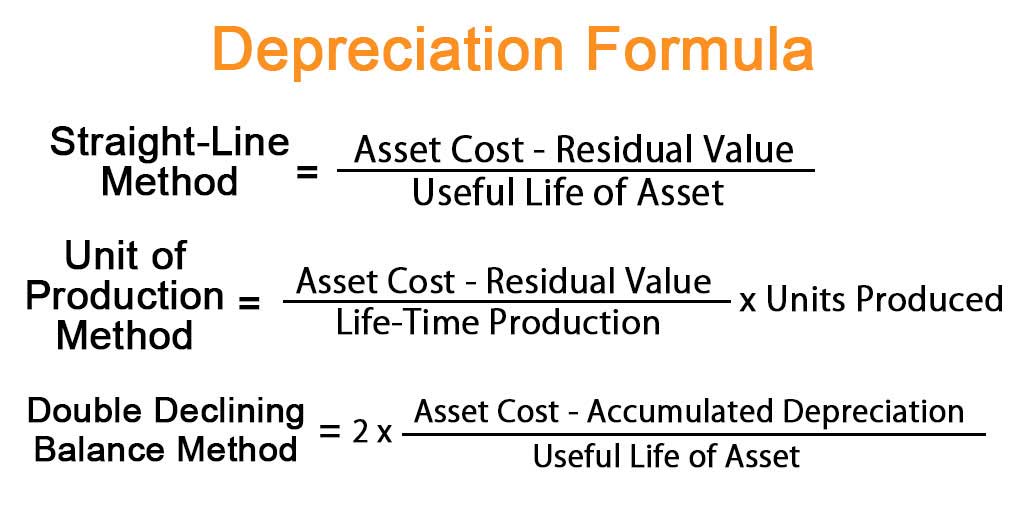

First one can choose the straight line method of. Divide the difference by years.

Exercise 6 5 Compound Depreciation Year 10 Mathematics

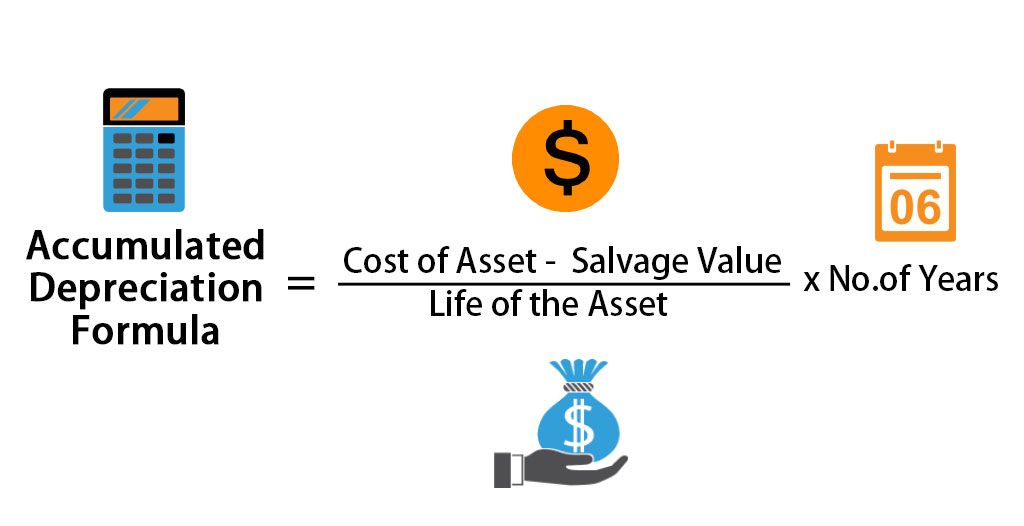

For example the total depreciation for 2023 is comprised of the 60k of depreciation from Year 1 61k of depreciation from Year 2 and then 62k of depreciation from Year 3 which comes.

. For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is in service for the entire year. This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime. Lets create the formula for straight-line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along.

Total yearly accumulated depreciation Asset cost - Expected salvage value Expected years of use 750 - 150 Expected years of use. Note that this figure is essentially equivalent to. Section 179 deduction dollar limits.

Second year depreciation 2 x 15 x 900 360. Under this method we transfer the amount of depreciation every. The depreciation amount changes from year to year using either of these methods so it more complicated to calculate than the straight-line method.

This limit is reduced by the amount by which the cost of. Depreciation Cost of asset Residual Value x Annuity factor. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

So in the second year your monthly depreciation falls to 30. Sinking fund or Depreciation fund Method. This depreciation calculator is for calculating the depreciation schedule of an asset.

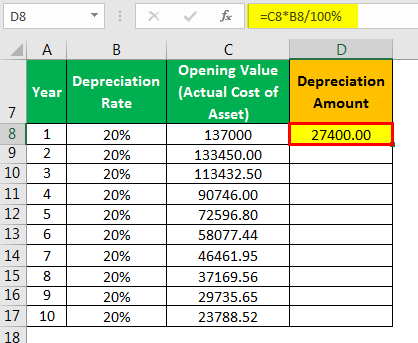

It provides a couple different methods of depreciation. We need to define the cost salvage and. Annual Depreciation rate Cost of Asset Net Scrap Value Useful Life.

You can calculate subsequent years in the same way with. If you use this method you must enter a fixed. There are various methods to calculate depreciation one of the most commonly used methods is the.

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Accumulated Depreciation Definition Formula Calculation

Depreciation Formula Calculate Depreciation Expense

A Complete Guide To Residual Value

Straight Line Depreciation Formula And Calculation Excel Template

Double Declining Balance Method Of Depreciation Accounting Corner

Ex Find Annual Depreciation Rate Given F T Ae Kt Youtube

Macrs Depreciation Calculator With Formula Nerd Counter

What Is Accumulated Depreciation How It Works And Why You Need It

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Double Declining Balance Method Of Depreciation Accounting Corner

Annual Depreciation Of A New Car Find The Future Value Youtube

Declining Balance Depreciation Double Entry Bookkeeping

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Calculation